SIDN has improved its financial position

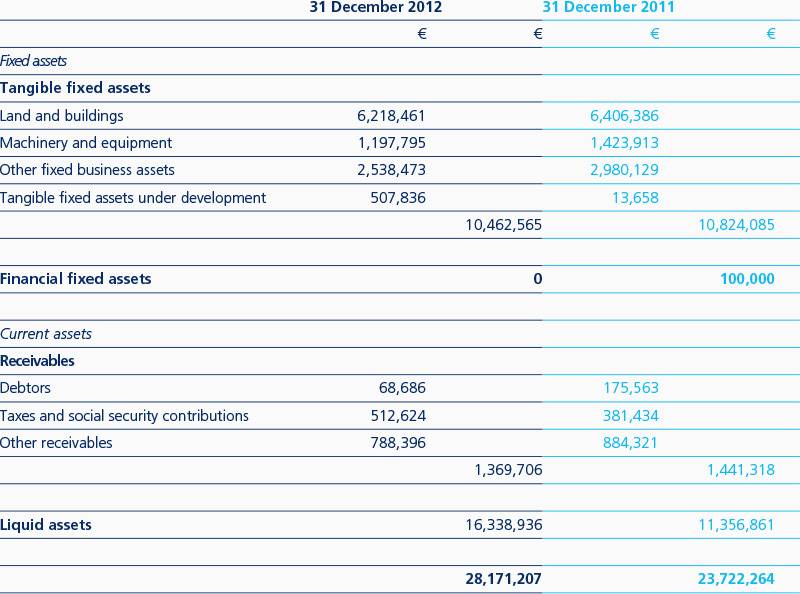

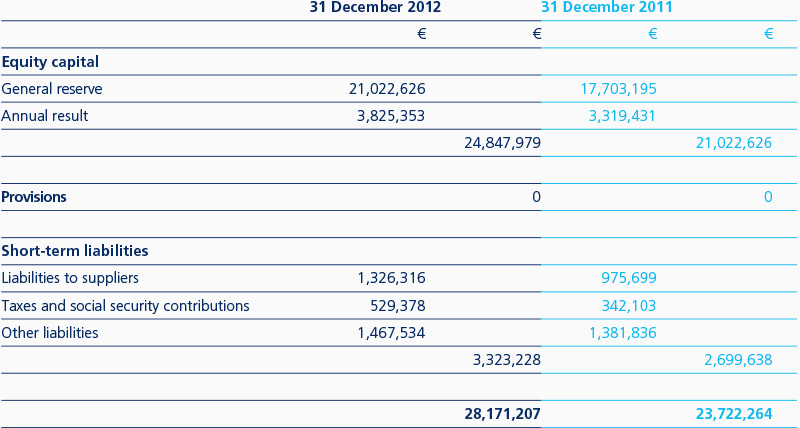

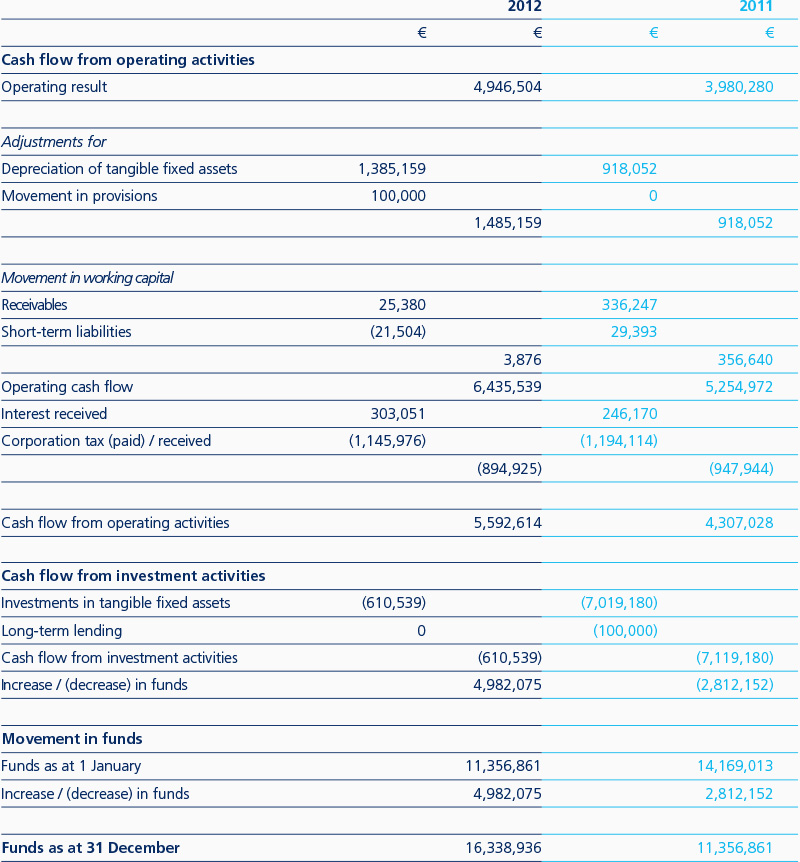

Due to the continued growth in domain names, the net result for 2012 was on € 3,825,000: more than half a million euros up on 2011. The surplus is to be allocated to the general reserve, thus increasing SIDN's equity capital at the close of 2012 to € 24,848,000. The equity capital serves as a financial buffer, which helps to assure the organisation's continuity. The size of the financial buffer needed is related to the organisation's structural cost base. Because that cost base has risen over the years, as the organisation has grown and the quality and stability requirements placed upon it have become greater, so it has been necessary to increase the financial buffer.

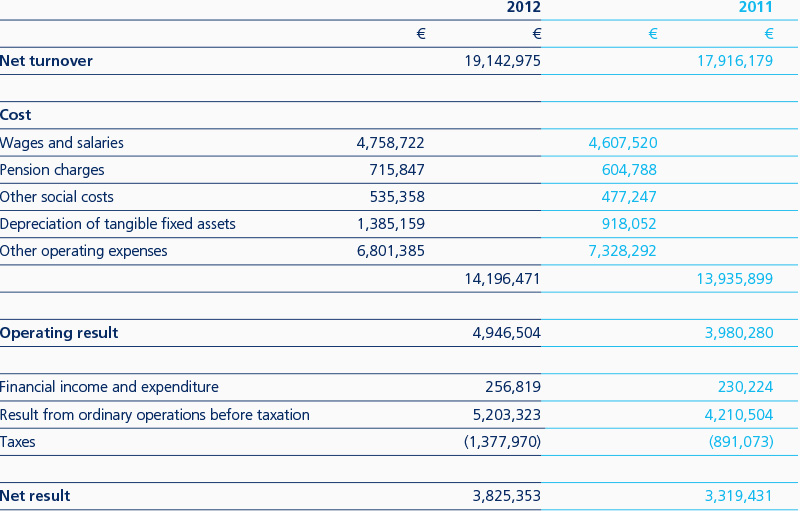

At € 4,947,000, the operating result for 2012 was € 967,000 higher than the 2011 result (€ 3,980,000). The improved operating result is attributable to increased turnover.

Turnover rose to € 19,143,000, compared with € 17,916,000 in 2011 – a year-on-year increase of 10.2 per cent (following 2011's 11.6 per cent increase). The turnover growth was attributable largely to the increase in the number of registered domain names. At the end of 2012, there were 5.1 million domain names, compared with 4.7 million a year earlier. The growth in the number of domain names was down on previous years, and the expectation is that growth is likely to continue easing in the years ahead. Due to the growth in the number of domain names, the total amount given in payment discounts and volume discounts was also greater than in 2011, negatively affecting the net turnover of € 190,000. In order to promote the use of DNSSEC-signed domain names, SIDN introduced a discount of € 0.07 per signed domain name in 2012. Including the € 197,000 DNSSEC discount for 2012, the total value of the discounts set off against the turnover was € 1,636,000: a 28 per cent increase on the 2011 total of € 1,250,000. The number of registrars continued to fall, and this too had a slight negative impact on net turnover.

While turnover grew, expenditure remained roughly unchanged. Total expenditure in 2012 was € 14,197,000, compared with € 13,936,000 in 2011 (a year in which expenditure rose by 15 per cent). The modest size of the expenditure growth in 2012 was due to the fact that there was little increase in personnel costs. Wages and salaries, including pension contributions and social security costs rose by € 300,000, mainly due to higher pension contributions and insurance premiums. In addition, the total number of FTEs rose to sixty-seven (compared with sixty-three in 2011).

Depreciation costs in 2012 were € 1,385,000: substantially higher than in 2011 (€ 918,000). The increase was attributable to depreciation of the new premises, which SIDN took possession of at the end of 2011, and of those premises' fixtures and fittings.

The other operating costs were € 6,801,000 in 2012 (2011: € 7,328,000). That figure is € 527,000 down on 2011. The fall was due mainly to a € 225,000 reduction in accommodation costs and a € 965,000 reduction in the marketing and communication expenditure. In 2011, roughly one million euros were spent on activities linked to SIDN's fifteenth anniversary and the .nl domain's silver jubilee. In 2012, a further € 475,000 was spent on ICT consultancy and temporary staff. Institutional costs also rose by € 117,000, largely because of an increased contribution to ICANN. Two debentures with a value of € 100,000 each are foreseen this year.

In 2012, SIDN invested a total of € 1,022,000 in DRS5 (€ 240,000) and office machinery (€ 297,000), some of which relates to ongoing ICT projects. The cost of those projects stood at € 494,000 at the end of 2012. The projects in question will enter use in the course of 2013.