SIDN strengthened its financial position

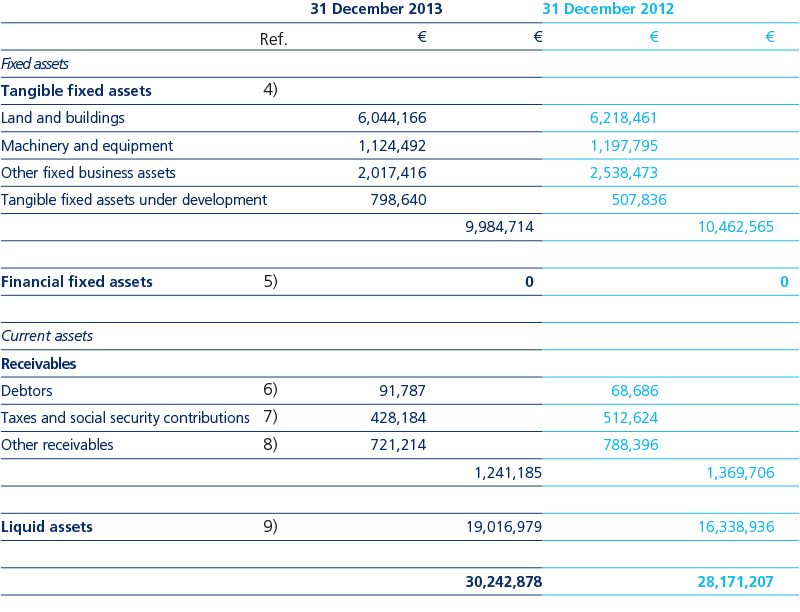

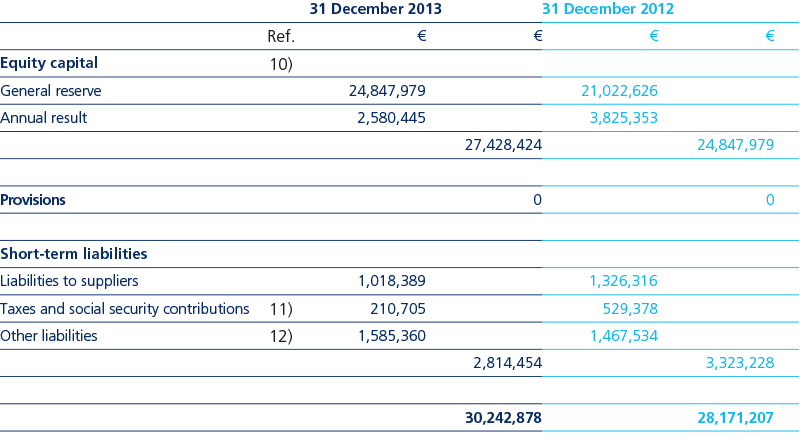

The net result for the year was € 2,580,000. The net result will be added to the general reserves, bringing the equity capital at the close of 2013 to € 27,428,000. The equity capital serves as a financial buffer, which helps to assure the organisation's continuity. The size of the financial buffer needed is related to the organisation's structural cost base. Because that cost base has risen over the years, as the organisation has grown and the quality and stability requirements placed upon it have become greater, so it has been necessary to increase the financial buffer. The net result was € 1,245,000 lower than that achieved in 2012.

The operating result for 2013 was € 3,214,000. That sum is € 1,732,000 lower than the corresponding figure for 2012 (€ 4,946,000). The reduction is attributable to lower net turnover and higher operating costs.

Net turnover in 2013 was € 18,762,000. As such, net turnover was € 381,000 lower than in 2012 (€ 19,143,000). That corresponds to a year-on-year decline of 2.0 per cent, whereas 2012's net turnover had been 10.2 per cent higher than the previous year. Net turnover fell mainly because, on 1 January 2013, SIDN switched to charging for newly registered domain names from the start of the next quarter, instead of from the quarter of registration. The associated loss of turnover was approximately € 717,000. At the end of 2013, there were roughly 5.4 million registered domain names, compared with 5.1 million at the end of 2012. The trend towards slower growth in the number of domain names remained evident in 2013: net growth in 2013 was 272,712, compared with 315,933 in 2012. SIDN expects that trend to continue in the years ahead. Due to the growth in the number of domain names, the total value of the payment discounts and volume discounts given was also greater than in 2012, depressing net turnover by € 119,000. In order to promote the use of DNSSEC to secure domain names, SIDN has paid a rebate of € 0.07 per secured domain name since July 2012. By the close of 2013, approximately 1.7 million .nl domain names were secured with DNSSEC (31.1 per cent of all .nl domain names). Including the DNSSEC rebate for 2012 (€ 453,000, compared with € 197,000 for 2012), the total value of the discounts and rebates set off against the turnover (DNSSEC rebate, volume discount and payment discount) was € 2,011,000: a 23 per cent increase on the 2012 total of € 1,636,000. The number of registrars continued to fall, from 1,682 at the end of 2012 to 1,570 at the end of 2013. That too had a slight negative impact on net turnover.

While turnover fell, costs rose in 2013 by € 1,351,000 (9.5 per cent). Total expenditure in 2013 was € 15,548,000, compared with € 14,197,000 in 2012. The rise in expenditure in 2013 is attributable mainly to higher personnel costs (up by € 1,424,000). The higher personnel costs consisted of the cost of hiring temporary staff to cover for personnel on prolonged sick leave and for vacancies that could not be filled (€ 764,000), higher pension contributions and insurance premiums (up € 155,000), general salary increases (€ 113,000) and one-off outplacement costs (€ 105,000). Another factor was an increase in the average number of employees, from sixty-seven FTEs in 2012 to seventy-two FTEs in 2013.

Depreciation costs in 2013 were € 1,430,000 – slightly higher than in 2012 (€ 1,385,000).

Other operating costs were € 6,683,000 in 2013: a reduction of € 118,000 on 2012 (€ 6,801,000). The cost reduction was due mainly to the fact that a number of one-off costs were incurred in 2012, including a provision of € 100,000 for two debentures and a provision of € 66,000 for dubious debts. In 2013, accommodation costs increased by € 58,000 on 2012, due to Real Estate Assessment Act charges for 2012 and 2013.

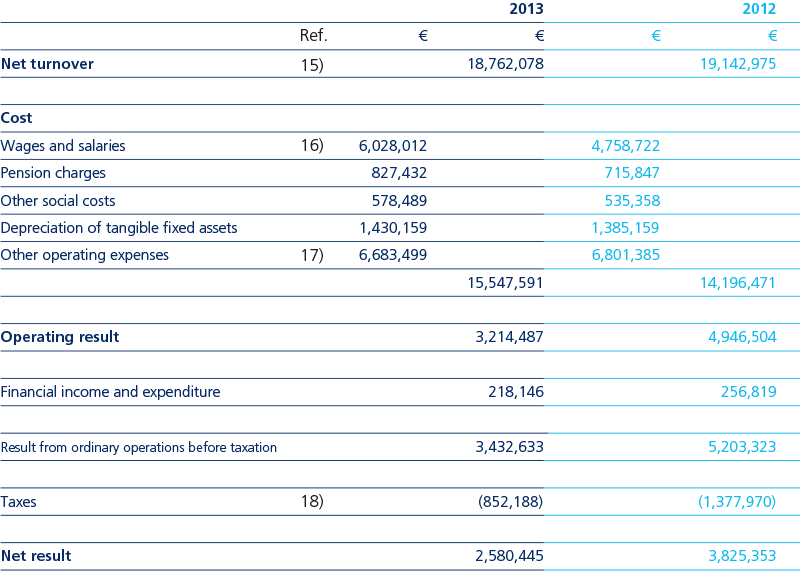

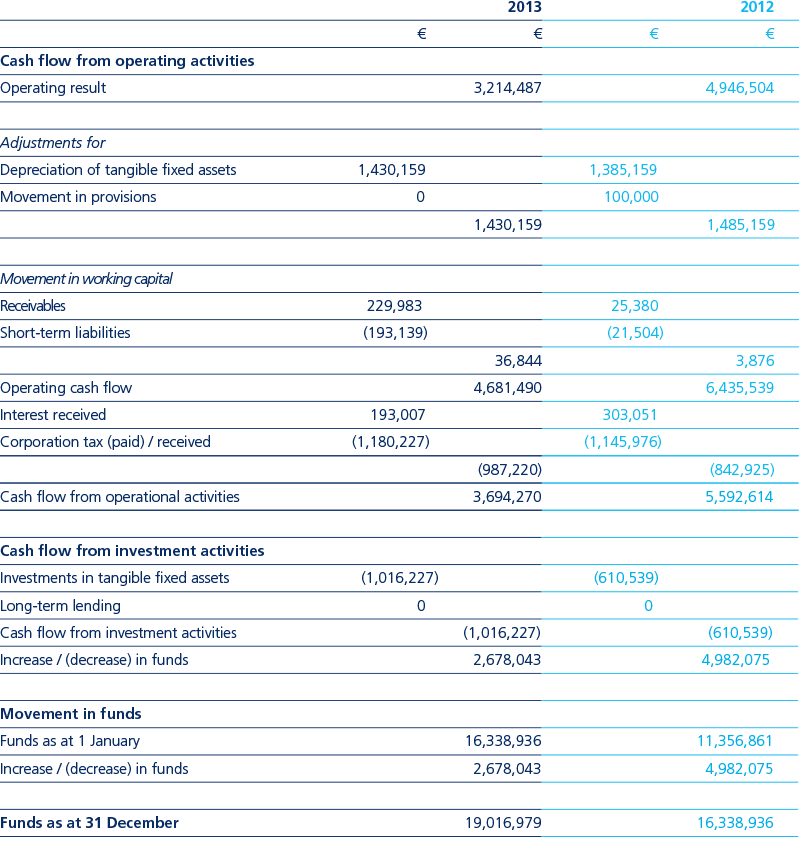

In 2013, SIDN invested a total of € 952,000, of which € 438,000 was spent on production systems and € 209,000 on office machinery. Out of the total capital expenditure sum, € 301,000 relates to ICT projects in progress. By the close of 2013, the total amount invested in those projects was € 799,000. The projects in question will enter use in the course of 2014.

Solvency increased further, from 88.2 per cent in 2012 to 90.7 per cent in 2013. In 2013, a positive cash flow of € 2,678,000 was generated.